Our Blog

How Did Rentals Perform in 2025?

Unpacking the Rental Market Trends of 2025

How Did Rentals Perform in 2025?

Life is crazy and often it passes us by without taking time to reflect. The year 2025 also went by rapidly, but before jumping into plans and goals for 2026, it is valuable to step back and glean from what happened this past year and what we can learn from it. This past year was dominated by a cooling real estate market which intersected with the inflationary pressures we’ve seen on many fronts, especially materials, labor, and property taxes. Referencing both inflation and taxes in one sentence may make you want to stop reading, but stick with me as it is not all bad news.

The challenges that were faced by rental property owners across Raleigh and Durham largely fell into these three categories.

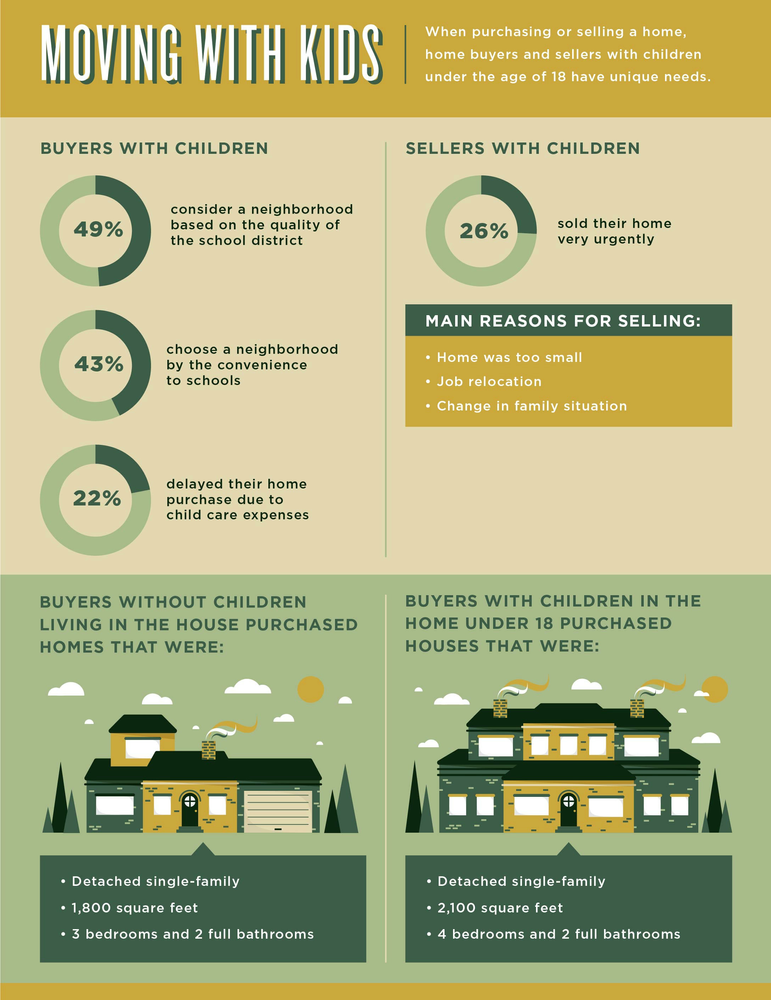

- Weakening Rental Demand: In line with the sales market, 2025 had a noticeable softening in rental demand. This could be seen by tenants shopping more, properties sitting on the market longer, and rents plateauing. Coming off of several years with double digit rent increases and record demand, the contrast has been felt acutely. Many owners we have spoken with relayed that they have never had this issue before. However, like all markets, there is a cyclical nature of real estate and the cooling we saw was modest compared to the historic pullback in 2008. Although the market has shifted significantly since 2021 and 2022, we see it as a necessary and even healthy adjustment to keep rent increases on a sustainable trajectory and avoid a major market adjustment.

- Increased Maintenance Expenses: Did it feel like costs for maintaining your rental property went up again this year? Based on Mortenson’s leading national index of construction pricing and materials, as of the third quarter of 2025, pricing did increase around 6.6%. For many property owners, there had been a hope that material and labor costs would come down as competition caused the trades to be more realistic after the last few years of pricing frenzy. At Apple Realty, we’ve seen pricing stabilize, but have certainly not seen the hope for reduction in costs. We have continued to work to ensure that every dollar spent on maintenance is with cost-effective vendors that deliver the best value for the price.

- Taxes: The annual dreaded tax bill received by property owners this year was further cause for concern and impacted the profitability of owning investment properties. In Durham County, a reappraisal of property values was conducted this year with the goal of bringing property values to 100% of market rate. Since 2019, the last 4-year appraisal cycle, property values in Durham have increased on average 70%. These new property valuations won’t go into effect until this year, but the 6% increase on property taxes in 2025 impacted the bottom line and was an additional hit for investors.

The silver lining from 2025 is that although the market is in correction, it has been a fairly soft landing from the real estate frenzy we experienced the past several years. The key for us at Apple Realty is to do all we can to maintain occupancy, as that is the best defense in a cool market against the rise in costs. The biggest lesson learned is that property owners who invest in upgrades and improvements to their properties have been rewarded with the least rent reductions and the highest occupancy rates. As hard as it is to make investments in your properties when money is tight, that has been the number one distinction between owners who have been hit hard and those that have weathered the cooling market with little impact.